Let’s stay connected

Sign up for the monthly Habitat GSF newsletter to stay in touch and keep up to date on affordable homebuilding and homeownership in San Francisco, San Mateo & Marin counties.

Habitat for Humanity Greater San Francisco is offering critical, major home repairs to support low-income, long-term homeowners living in Marin County. These Home Improvement and Repair services address safety, accessibility, and deferred maintenance issues. Applications are open now and will be processed on a first-come, first-served basis.

This program is made possible with support from the County of Marin’s Community Development Block Grant program.

Loan amounts between $25,000 and $75,000 are available for home improvement and repair needs. We are committed to working with qualified applicants to determine the loan amount that best suits their needs.

I worked for the city. I raised my children and volunteered in this very community. There is nowhere else I have called home.”

| Number of Persons in Household | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| Maximum Household Income | $108,300 | $123,800 | $139,250 | $154,700 | $167,100 | $179,500 | $191,850 | $204,250 |

If you have applied for a Habitat for Humanity Greater San Francisco home repair service in the past, you will need to submit a new application for these home repair services.

The selection process includes a review of your finances and credit, homeownership history, and residency. In addition, for Habitat for Humanity Greater San Francisco’s loan program the household must be low income with annual household income that is at or below the maximums listed in the chart above.

If you have any questions, please contact the Home Preservation Department at homerepairs@habitatgsf.org or 415-625-1036.

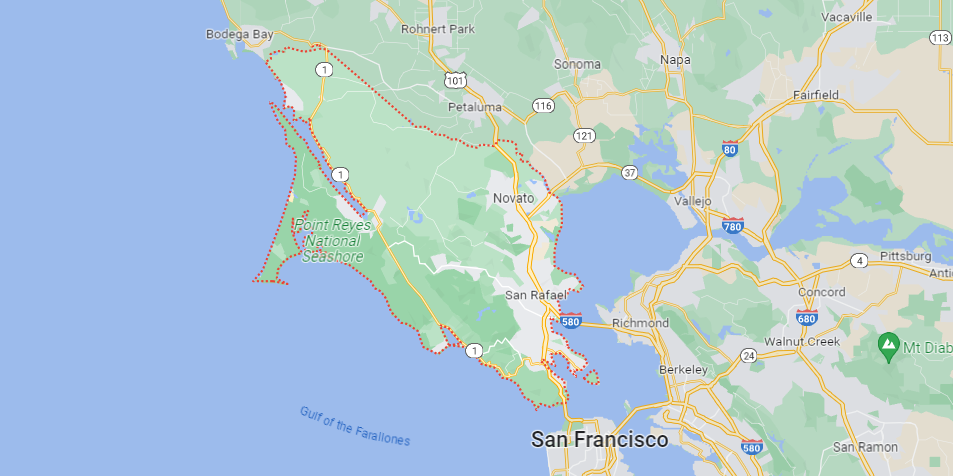

Homeowners who live in Marin County are eligible to apply.

How do I pay for the repairs I need?

What is the minimum credit score to qualify for this program?

Is this loan a second mortgage or a reverse mortgage?

What’s Habitat for Humanity GSF’s history with lending?

How do I know if this loan and partnering with Habitat for Humanity Greater San Francisco is the right choice for me?

How can I trust Habitat as a lender, I have seen a lot of people lose their home over the years due to subprime lending practices?

How do I know if this is the right program for me? I have deferred maintenance needs, but I am not sure if this program is the right fit.

Please reach out to our Home Preservation team with any questions: HomeRepairs@HabitatGSF.org or 415-625-1036.